Welcome to our blog on QuickBooks Reconciliation Report! Running a business is no easy task, and keeping track of your finances is one of the most important aspects of it. QuickBooks is a powerful tool that can help you to manage your finances, but it's essential to understand how to use it effectively.

That's where the QuickBooks Reconciliation Report comes in. This blog will deeply dive into the QuickBooks Reconciliation Report and explore its many features and advantages.

We will cover topics such as the key features of QuickBooks, invoice raising, expense management, payroll management, data imports, and the benefits of using QuickBooks. We will also discuss how to view and print the report and export it to Excel.

Introduction to Quickbooks

QuickBooks is a robust accounting software that can help businesses manage their finances effectively. Whether you're a small business owner, accountant, or financial professional, QuickBooks can help you keep track of your income and expenses, create invoices, manage your payroll, and more.

One of the key features of QuickBooks is its ability to automatically reconcile your bank and credit card transactions, ensuring that your financial records are accurate and up-to-date. This is done by comparing your financial records to your bank or other financial institution and identifying any discrepancies or errors.

QuickBooks offers many other features, such as inventory management, tax preparation, and budgeting. It also integrates with other tools such as time tracking, e-commerce, and point-of-sale systems, making it a one-stop shop for all your business needs.

Key features of Quickbooks

QuickBooks is a robust accounting software that offers a wide range of features to help you manage your finances. QuickBooks is a comprehensive financial management software with many features to help you manage your finances.

With its ability to reconcile accounts, track income and expenses, and customise the software to your specific needs, QuickBooks is an essential tool for businesses of all sizes.

And with its ability to integrate with other software and services, QuickBooks can help you streamline your business operations and better understand your financial data. To expand further on features:

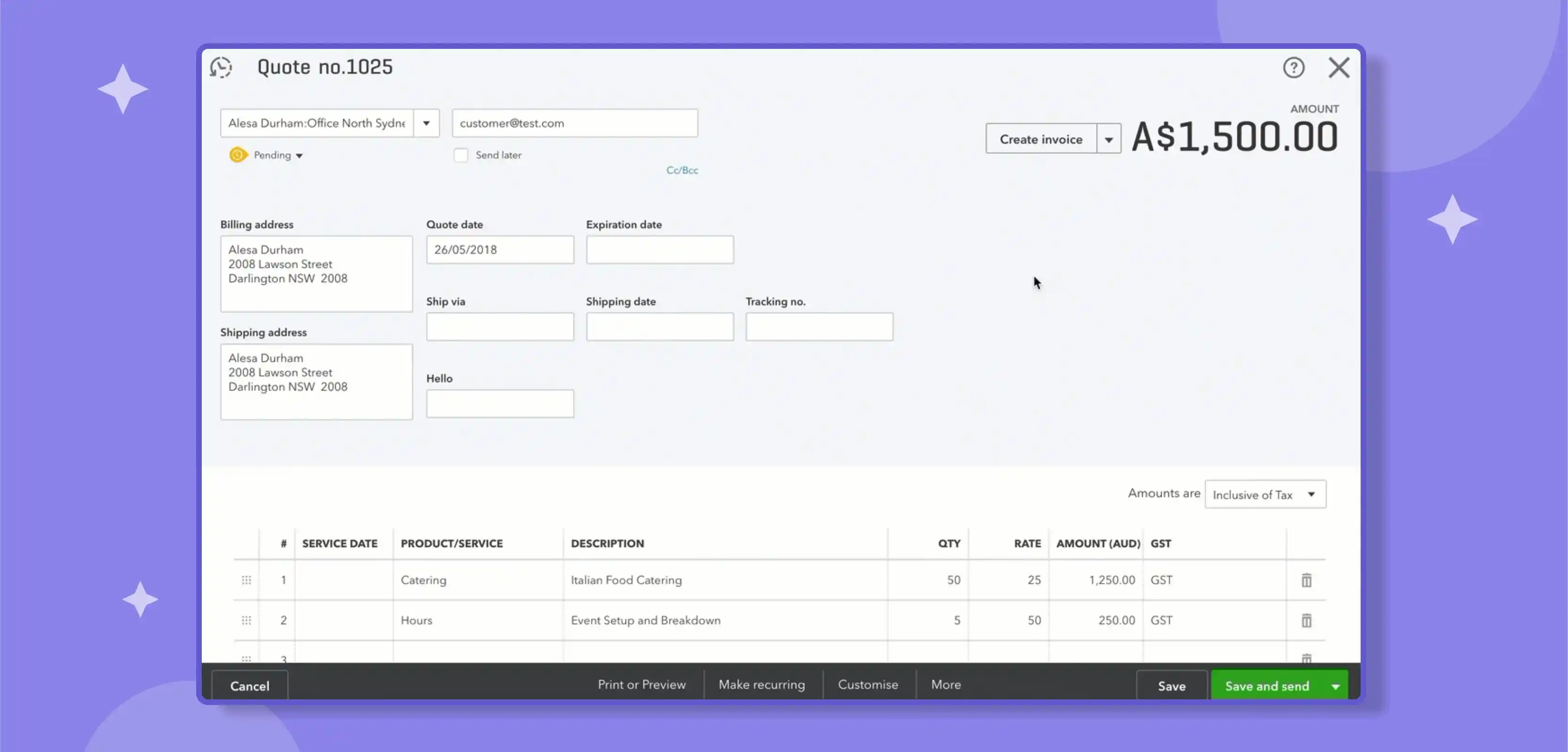

1. Invoice raising:

Invoice raising is an essential part of any business, and QuickBooks makes it easy to create, send and track invoices. With QuickBooks, you can create professional invoices in minutes and customise them with your company logo, business details, and any additional information you need to include.

Creating an invoice in QuickBooks is simple; you can either create a new invoice from scratch or duplicate an existing one.

Once you've selected the appropriate template, you can enter your invoice details, such as the customer name, invoice number, and the items or services you're billing for. You can also add any applicable discounts, taxes, and shipping charges.

QuickBooks also allows you to set up recurring invoices, saving time and effort. Suppose you bill your customers on regularly recurring invoices. In that case, you can set up a schedule for when the invoices will be sent, and QuickBooks will automatically generate and send them on the specified dates.

Once your invoice is created, you can easily send it to your customer via email or print it out and mail it. You can also track the status of your invoices and see if they have been viewed, paid, or are overdue.

This makes it easy to follow up with customers who still need to pay their invoices and helps you manage your cash flow.

2. Expense management:

Expense management is a crucial aspect of any business, and QuickBooks makes tracking and managing your expenses manageable. With QuickBooks, you can easily create and track purchase orders, bills, and costs and even set up automatic rules to categorise them.

This makes it easy to see where your money is going and identify areas where you can cut costs.

One of the key features of QuickBooks for expense management is the ability to create and track purchase orders. You can easily create purchase orders for goods or services and then follow them to ensure they have been received and paid.

This helps you be on top of your suppliers and ensure that you pay the right amount for the goods or services you receive.

Another essential feature of QuickBooks is the ability to track bills and expenses. You can quickly enter your bills and expenses and assign them to the appropriate categories, such as office supplies or travel expenses.

QuickBooks also allows you to set up automatic rules to categorise your bills and expenses, saving you time and effort.

QuickBooks also provides a wide range of financial reports to help you better understand your expenses. With these reports, you can easily see where your money is going, identify areas where you're overspending, and make informed decisions about managing your expenses.

3. Payroll management:

Payroll management is essential to running a business, and QuickBooks makes it easy to set up and manage payroll for your employees. With QuickBooks, you can easily track employee hours, calculate paychecks, and even set up automatic deductions for taxes and other deductions.

One of the key features of QuickBooks for payroll management is the ability to track employee hours. You can easily set up employee time tracking in QuickBooks and then use this information to calculate paychecks. You can also set different pay rates for employees or job roles and even overtime or holiday pay rates.

Another critical feature of QuickBooks is the ability to set up and manage deductions. You can easily set up automatic deductions for taxes and other deductions, such as employee benefits or 401(k) contributions.

This helps you stay compliant with tax laws and regulations and ensures that your employees get the right amount of money in their paychecks.

QuickBooks also allows you to generate and print paychecks and even direct deposit the paychecks to your employees' bank accounts. You can also create and print pay stubs that give your employees detailed information about their pay, deductions, and taxes.

4. Data imports:

Data imports are an essential feature of QuickBooks, allowing you to quickly bring financial data from other sources into your QuickBooks account. This can save you significant time and effort and help you keep your financial records accurate and up-to-date.

QuickBooks supports various data import formats, including CSV, Excel, and IIF files. This makes it easy to import data from other accounting software, such as Xero, or a spreadsheet you've created. You can also import data from your bank or credit card statements, saving you time and effort when reconciling your accounts.

The process of importing data into QuickBooks is simple. You can select the file you want to import and map the fields from the file to the corresponding fields in QuickBooks. QuickBooks also allows you to set up automatic data import rules, saving you time and effort.

Once your data is imported, it is automatically integrated into your QuickBooks account. You can start working with the data immediately without manually entering it into QuickBooks.

You can also use the imported data to generate financial reports, such as balance sheets and income statements, which can help you better understand your financial data.

Advantages of using Quickbooks

QuickBooks is a robust accounting software that offers many benefits to businesses of all sizes. With its ability to manage finances, track income and expenses, and streamline business operations, QuickBooks can help you save time and effort while providing you with the insights you need to make informed business decisions.

One of the most significant advantages of using QuickBooks is its ability to streamline financial management. With QuickBooks, you can easily track income and expenses, reconcile accounts, and even set up and manage payroll. This helps you stay on top of your finances and ensure that your books are in good order.

Another advantage of QuickBooks is its ability to provide detailed financial reports. With QuickBooks, you can quickly generate various financial information, such as balance sheets, income, and cash flow statements. These reports can help you understand your financial data and make informed business decisions.

QuickBooks also offers a wide range of customisation options that can help you tailor the software to your specific needs. You can create custom forms, such as invoices and purchase orders, and customize the fields to include the most crucial information.

You can also create custom reports and charts to help you analyze your financial data and make informed business decisions.

1. Better integrations:

One of the significant advantages of using QuickBooks is its ability to integrate with other software and services. QuickBooks can integrate with many popular tools, such as PayPal, Square, and Stripe, making it easy to accept payments and track sales. This can help you streamline your business operations and save time and effort.

You can also connect QuickBooks with other accounting software, such as Xero, and your website to help streamline your business operations. This allows you to access and manage your financial data from one central location rather than switching between multiple systems.

QuickBooks also integrates with many apps and add-ons, such as inventory management, project management, and CRM software. This allows you to easily manage multiple aspects of your business in one place and access all the data you need to make informed business decisions.

The integrations feature also allows you to automate repetitive tasks, such as data entry, and eliminates the need for manual data entry, saving you time and effort. This helps you to focus on growing your business and making informed decisions rather than getting bogged down in administrative tasks.

2. Easy to use:

One of the significant advantages of using QuickBooks is its ease of use. QuickBooks is designed to be user-friendly, making it easy for business owners, even those without a background in accounting, to navigate the software and manage their finances.

QuickBooks offers a simple and intuitive interface with straightforward and easy-to-use navigation. This makes it easy to find the needed features and perform tasks such as creating invoices, tracking expenses, and generating financial reports.

QuickBooks also offers a wide range of helpful resources, such as tutorials and guides, to help users understand and navigate the software. This makes it easy to start with QuickBooks, even if you have little or no experience with accounting software.

QuickBooks also offers a wide range of customisation options, allowing you to tailor the software to your specific needs. You can create custom forms, such as invoices and purchase orders, and customise the fields to include the most crucial information. This makes it easy to use QuickBooks to manage your business finances, regardless of the size or industry of your business.

3. Better security:

QuickBooks offers a wide range of security features to help protect your financial data and keep it safe from unauthorised access. One of the significant advantages of using QuickBooks is its ability to provide better security than manual bookkeeping methods.

QuickBooks uses various security measures to protect your data, including encryption, secure hosting, and multi-factor authentication. This helps to protect your data from cyber threats, such as hacking and malware.

QuickBooks also offers the option to set up user permissions, which allows you to control who has access to your financial data and what actions they can perform. This helps to prevent unauthorised access to your data and ensures that only authorised personnel can view and make changes to your financial records.

In addition, QuickBooks also offers a feature called Audit Trail, which records all the changes made to your financial data; it allows you to track changes and know who made them, when, and why. This helps you to keep track of your financial data and makes it easy to detect and rectify any errors or discrepancies.

4. Better tax deductions:

One of the significant advantages of using QuickBooks is its ability to help you take advantage of tax deductions. With QuickBooks, you can easily track your income and expenses and even set up automatic rules to categorise them.

This makes it easy to identify deductions that you may be eligible for, such as those for business expenses, and helps you ensure that you're taking full advantage of the deductions available.

QuickBooks also allows you to track mileage easily; this is one of the most common tax deductions for small business owners and the most overlooked deduction.

With QuickBooks, you can easily track your mileage and even set up automatic rules to categorise it, which can help you to ensure that you're taking full advantage of this deduction.

QuickBooks also allows you to easily track employee expenses, such as those for travel, training, and other business-related costs. This makes it easy to identify deductions that you may be eligible for and ensures that you're taking full advantage of the deductions available to you.

Furthermore, QuickBooks offers a wide range of financial reports that can help you better understand your expenses. With these reports, you can easily see where your money is going and identify potential deductions you may have missed.

By analysing your financial data in Excel, you can identify patterns and trends in your spending and make adjustments to your business operations to maximise your deductions.

For example, if you're spending a lot on business travel, you can take advantage of deductions for airfare, lodging, and other travel expenses. Or, if you're spending a lot of money on office supplies, you can take advantage of deductions for office equipment and other business expenses.

Exporting your QuickBooks Reconciliation Report to Excel allows you to share your financial data with your accountant or other financial professionals. They can use the data to prepare your taxes and help you take advantage of all the deductions for which you're eligible.

Introduction to Quickbooks Reconciliation Report

Reconciliation is essential to keeping your business's financial records in order. It is the process of comparing your company's financial records to the records of your bank or other financial institution to ensure that they match.

Reconciliation is necessary because it helps you to identify errors, discrepancies, or fraudulent activity and ensures that your financial records are accurate and up-to-date.

QuickBooks offers a powerful reconciliation feature that makes it easy to reconcile your accounts and ensure that your financial records are accurate. The QuickBooks Reconciliation Report is a powerful tool that allows you to compare your financial records to those of your bank or other financial institution.

With this report, you can quickly identify any discrepancies or errors and make the necessary adjustments to ensure that your records are accurate.

The QuickBooks Reconciliation Report also allows you to track your transactions and account balances over time. This makes it easy to identify trends in your financial data, such as changes in your income or expenses, and helps you to make informed business decisions.

The report also allows you to view previous reconciliations. It can help you identify patterns or errors that have occurred in the past and take steps to prevent them from happening again. This can help you to improve your financial processes and make your business more efficient.

Furthermore, QuickBooks also allows you to set up automatic rules for reconciliation, saving you time and effort. With automated rules, you can set up a schedule for when the reconciliation will be done, and QuickBooks will automatically generate the report on the specified dates.

Viewing & exporting Quickbooks Reconciliation Reports

Viewing and exporting your QuickBooks Reconciliation Reports is integral to managing your business's financial records. With QuickBooks, you can easily view and export your reports, which makes it easy to share them with your accountant, business partners, or other stakeholders.

To view your QuickBooks Reconciliation Reports, go to the "Reports" menu in QuickBooks and select the "Reconciliation" option. This will open the report, allowing you to view your account balances, transactions, and any discrepancies or errors.

In addition to viewing your reports, QuickBooks also makes it easy to export them. You can export your information in various formats, including PDF, Excel, and CSV. This makes it easy to share your reports with others, such as your accountant, business partners, or other stakeholders.

Exporting your QuickBooks Reconciliation Reports also allows you to archive them for future reference; this can be helpful for your internal records or compliance with regulations. This can help you efficiently access your financial data and keep track of your business's economic history.

Another great feature of QuickBooks is the ability to customise the reports. You can customise the definition to include only the relevant information about your business.

You can filter the data to include only specific accounts, dates, or other criteria. This makes it easy to find your needed information and make informed business decisions.

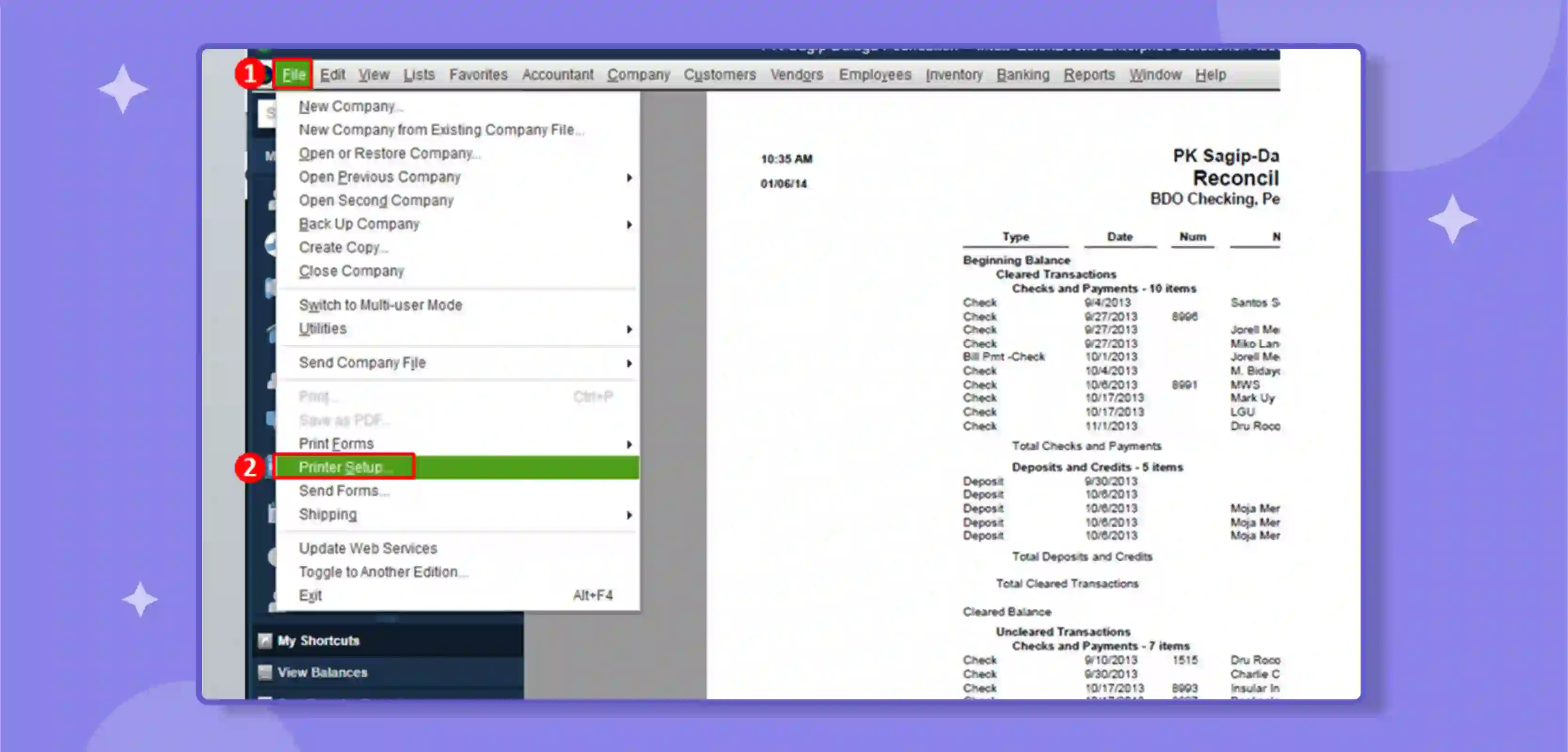

How to view and print Quickbooks Reconciliation Reports

Viewing and printing your QuickBooks Reconciliation Reports is essential to managing your business's financial records. With QuickBooks, you can easily view and print your reports, which makes it easy to share them with your accountant, business partners, or other stakeholders.

To view your QuickBooks Reconciliation Reports, go to the "Reports" menu in QuickBooks and select the "Reconciliation" option. This will open the report, allowing you to view your account balances, transactions, and any discrepancies or errors.

You can customise the definition to include only the relevant information to your business and filter the data to include only specific accounts, dates, or other criteria.

Once you've reviewed your report, you can easily print it. To do this, click on the "Print" button located at the top of the information, or select the "Print" option from the "File" menu. This will open the print dialogue box, where you can choose your print settings, such as the number of copies, the printer, and the paper size.

Another option is to export the report as a PDF file; this can be helpful if you want to share the information with someone who doesn't have access to QuickBooks. To export the report as a PDF, click on the "Export" button located at the top of the report or select the "Export" option from the "File" menu.

You can also schedule and automate the printing of the reconciliation report; this can be useful if you want to generate the information at a specific time or date and have it printed automatically. This can help you to save time and effort and ensure that your financial records are always up-to-date.

How to export Quickbooks Reconciliation Report to Excel

Exporting your QuickBooks Reconciliation Report to Excel is a great way to share your financial data with others and keep a record of your business's financial history.

With QuickBooks, you can easily export your reports in various formats, including Excel, which makes it easy to share your reports with others, such as your accountant, business partners, or other stakeholders.

To export your QuickBooks Reconciliation Report to Excel, go to the "Reports" menu in QuickBooks, and select the "Reconciliation" option. This will open the report, allowing you to view your account balances, transactions, and any discrepancies or errors.

Once you've reviewed your report, you can easily export it to Excel. To do this, click on the "Export" button located at the top of the report, or select the "Export" option from the "File" menu. This will open the export dialogue box, where you can export the report in a vavariousmats, including Excel.

When you export your report to Excel, all of the data from the report will be exported into an Excel spreadsheet. This includes all the data you see in the report, such as account balances, transactions, and discrepancies or errors.

This makes it easy to share your financial data with others and keep a record of your business's financial history.

In Excel, you can also perform further analysis; you can sort, filter, and group the data to see different perspectives on your financial data.

For example, you can sort the data by account or date to see how your spending changes over time. You can also filter the data to see only specific transactions, such as credit card transactions or tran a particular vendor.

You can also use Excel's built-in functions and formulas to perform calculations and create charts and graphs to visualise your financial data. This can help you to identify patterns and trends in your spending and make better-informed business decisions.

You can also use Excel's conditional formatting to highlight specific cells or ranges of cells that meet certain criteria; this can be useful to identify any discrepancies or errors in your data quickly. You can also use Excel's Pivot Tables to summarise, analyse, and compare large amounts of data.

Conclusion

In conclusion, QuickBooks Reconciliation Report is a powerful tool that can help you to ensure that your financial records are accurate and up-to-date.

With its ability to compare your financial records to those of your bank or other financial institution, you can quickly identify any discrepancies or errors and make the necessary adjustments to ensure that your records are accurate.

The QuickBooks Reconciliation Report also allows you to track your transactions and account balances over time, view previous reconciliations, set up automatic rules, and customise the reports. This can help you to identify trends in your financial data, such as changes in your income or expenses, and make informed business decisions.

In addition, the QuickBooks Reconciliation Report also offers a wide range of advantages, such as better security, better tax deductions, and better integrations.

These advantages can help you to protect your financial data from unauthorised access, take advantage of tax deductions, and improve your financial processes.

Furthermore, QuickBooks also allows you to view and print your Reconciliation Reports and export them to Excel. This makes it easy to share your reports with others, such as your accountant, business partners, or other stakeholders.

This can help you record your business's financial history, share your financial data with others, and make further analyses.

Overall, QuickBooks Reconciliation Report is a valuable tool for business owners to keep their financial records in order. It offers a wide range of features and advantages that can help you to manage your finances, improve your financial processes, and make informed business decisions.

With its user-friendly interface, helpful resources, and customisation options, QuickBooks makes it.

drives valuable insights

Organize your big data operations with a free forever plan

An agentic platform revolutionizing workflow management and automation through AI-driven solutions. It enables seamless tool integration, real-time decision-making, and enhanced productivity

Here’s what we do in the meeting:

- Experience Boltic's features firsthand.

- Learn how to automate your data workflows.

- Get answers to your specific questions.

.avif)

.png)