The financial industry is changing fast, and honestly, AI is in the middle of it. This is no longer sci-fi, because major banks have already implemented AI systems that deliver real results. JPMorgan Chase alone is saving 2 billion dollars through AI-based improvements, and Bank of America's AI chatbot (Erica) has now surpassed 3 billion client interactions and averages more than 58 million interactions per month.

For financial institutions, the question isn't whether to adopt AI; it's how quickly they can implement workflow automation in finance without interfering with current operations.

In this article, we will discuss the applications of AI in the field of finance, provide real-world examples, discuss the advantages of its application, and mention how a platform like Boltic can be used as a practical example of integrating AI in finance.

Why AI Matters in Finance Right Now?

If you've worked in financial services, you know the pressure is real. Banks are processing more transactions than ever, compliance requirements are being tightened by the regulators, and customers want to receive instant services 24/7.

In the meantime, fintechs are taking over by providing leaner and faster operations. Conventional fraud detection mechanisms are not able to keep up. Manual credit underwriting is a nightmare, and customer service is drowning.

AI solves these problems directly. It doesn't replace people; it augments what they can do.

- Fraud analysts with insights powered by AI can make informed decisions in a few seconds rather than several hours.

- A loan officer can approve creditworthy clients whom the ancient scoring systems would have otherwise denied credit.

- A customer service team can handle 10x the volume without hiring 10 times the staff.

DBS Bank was the actual wake-up call. They have rolled out 1,500 models of AI in over 370 applications and have generated a total of S$1+ billion in AI-driven revenue from intelligent workflow automation in finance. They are not an outlier, but a glimpse of where the industry is heading.

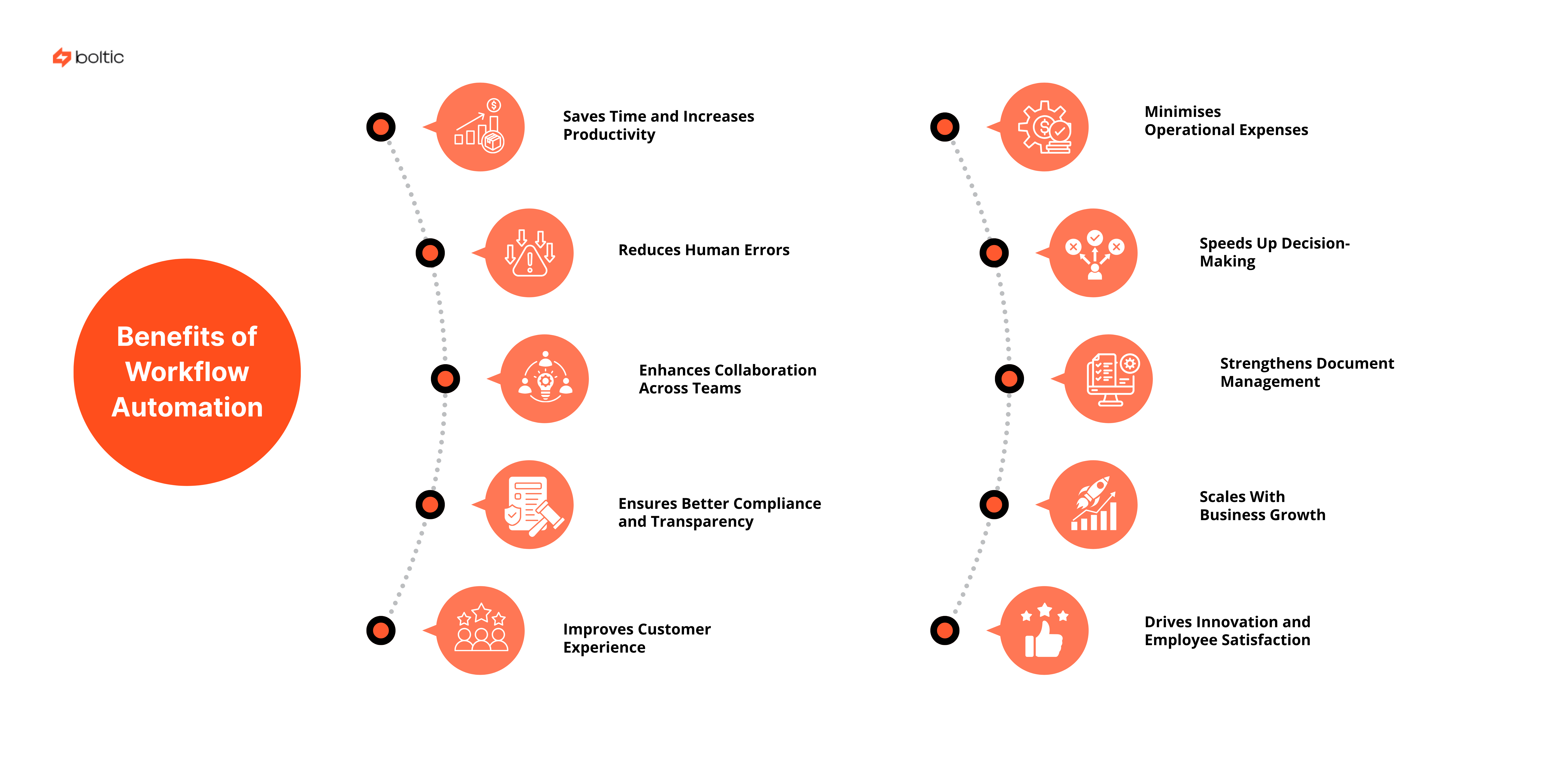

Benefits of AI in Finance

Before we see how AI is applied in core applications in various aspects of the finance industry, it’s important to understand its benefits.

- Speed: The detection of fraud takes place within milliseconds. Decision-making on loans is made instantly rather than days. Customer inquiries are answered immediately.

- Accuracy: AI recognizes fraud trends that humans might miss, spots risk earlier, and helps to have fairer credit behavior. This safeguards the institution and enhances customer outcomes.

- Scale Without Headcount: AI systems process millions of decisions every day without requiring equivalent staffing increases. This is how financial institutions scale sustainably.

- Cost Reduction: Automating repetitive tasks cuts operational expenses dramatically while improving speed, consistency, and overall quality.

- Improved Customer Relationship: Having routine tasks being handled by AI, human teams can invest more in problem resolution and forming relationships. This results in loyalty and increased retention.

- Regulatory Compliance & Transparency: Automated monitoring, reporting, and compliance workflows reduce manual errors, strengthen oversight, and lower non-compliance risk.

- Strategic Insights & Forecasting: AI analytics detect patterns and trends, helping institutions with strategic planning, allocation of investments, and forecasting market trends.

Core Applications of AI in Finance

Here are common and impactful AI applications across the finance sector:

- Fraud Detection & Prevention

AI fraud detection works fundamentally differently from traditional systems. The conventional methods were based on fixed programmed rules; if a transaction didn't match the pattern, it was flagged. Rules that were soon circumvented by fraudsters. AI systems are different. They study patterns, identify anomalies, and adjust in real-time as new tactics of fraud are discovered.

The shift matters because it means fewer false positives. Once legitimate transactions are wrongly flagged, the customers get frustrated and churn. Modern workflow automation in finance ensures these alerts reach the right analyst instantly.

- Credit Scoring & Underwriting

Conventional credit scoring considers the same factors all the time: income, credit history, and employment stability. It is a limited perspective that disadvantages individuals who could actually be reliable borrowers. They might have irregular income but excellent spending discipline. Or they could be first-time credit builders.

AI approaches credit differently. It examines the patterns of spending, payment behavior, cash flow trends, and behavioral indicators. This gives a fuller picture of creditworthiness. The advantage? Lenders identify creditworthy customers that traditional models would reject, while actually reducing risk through better pattern recognition.

- Customer Service & Support

Each year, banks have to process millions of customer inquiries that consist of balance inquiries, transaction history, and password resets, as well as billing issues. Customers want answers immediately, instead of waiting for an agent. AI chatbots and virtual assistants handle these routine questions 24/7.

But modern AI goes beyond robotic responses. It knows the context, customer history, and purpose. A customer asking about "charges on my account" gets a personalized response based on their recent transactions, not a generic template. The speed is as important as the quality of interaction.

- Algorithmic Trading & Portfolio Management

Trading markets move in milliseconds. A human trader can't process market information, economic events, sentiment signals, and historical trends quickly enough to take advantage of opportunities that can emerge and vanish in a few minutes. AI can.

AI trading consists of processing large volumes of data: price movements, macroeconomic indicators, social sentiment, and other sources of data to detect patterns and implement them at machine speed. The advantage isn't just speed; it's pattern recognition that human analysts would miss.

- Regulatory Compliance & Reporting

Compliance is a constant headache for banks. Anti-money laundering, Know Your Customer requirements, reporting, and audit trails are causing more regulatory pressure every year. Compliance teams traditionally monitored millions of transactions manually, looking for suspicious patterns.

AI automates this work. It tracks transactions on the fly, marks the suspicious cases, directs the cases to an analyst, and automatically generates audit trails. The systems get better with time because they learn what actually matters from feedback. Implementing workflow automation in finance for compliance reduces manual errors and ensures consistent monitoring.

Real-World Examples of AI in Finance

AI works on paper, sure, but does it work across multiple industries in finance? The answer is indeed, yes. And the examples below prove that.

- JPMorgan Chase: Fraud Detection at Scale

JPMorgan Chase has become one of the strongest industry examples of AI-driven fraud detection. The bank uses machine learning systems to analyze transactions in real time and identify unusual behavior far faster than traditional rule-based tools.

How JPMorgan uses AI:

- Detects credit card anomalies and suspicious behavior in real time

- Achieves 98% accuracy in detecting fraudulent behavior

- Reduces false positives by 95% for anti-money laundering systems

- Flags possible money-laundering patterns automatically

- DBS Bank: AI-Driven Risk Insights

DBS integrates AI across its credit and risk functions to strengthen decision-making. Their systems help identify early indicators of financial stress, allowing the bank to review accounts and potential risks more efficiently.

Where DBS applies AI in risk:

- 85% Reduction in Manual Processing Time

- Automated Assessment of 380,000+ Lending Applications Annually

- Processing 1.8 Million Transactions Per Hour (AML System)

- 45 Million Monthly Customer Interactions via AI

- 160 Million Transactions Processed Daily (Data Platform)

- Commonwealth Bank: Faster Credit Processes

Commonwealth Bank of Australia uses AI and automation to streamline parts of its lending workflows. By automating document checks and repetitive data tasks, the bank accelerates credit processing and reduces operational friction.

AI improvements in their credit workflow:

- Conditional loan approvals now complete in under 10 minutes (previously took days)

- Annual credit reviews reduced from 14 hours to 2 hours

- Achieved 50-85% accuracy on automated document extraction and KYC automation

- 76% Reduction in Scam Losses

Potential Risks with AI in Finance

AI isn't risk-free, and responsible institutions need to think carefully about implementation.

Boltic: Powering Workflow Automation in Finance

Banks that get the most value from AI don’t deploy models in isolation. They build connected workflows that link onboarding, KYC, risk scoring, compliance, loan processing, and customer support into one automated sequence.

That is the reason why no-code workflow platforms are relevant. The legacy systems that most banks are still on do not integrate well, and each workflow update is slow and requires developer intervention. A solution such as Boltic can bridge this gap because it lets financial teams create AI-integrated workflows in a visually defined manner.

Boltic creates workflows that can:

- Automatically categorize incoming support tickets using intent-based AI

- Route high-risk or complex issues to compliance or risk specialists

- Activate escalating workflows in case of the violation of SLAs.

- Send payment reminders or KYC alerts automatically

- Pull customer history from CRMs in real time to personalize responses

Because Boltic workflows are no-code, teams can adjust processes rapidly when regulations shift or new products launch with easy-to-implement visual workflows.

To automate support, collections, onboarding, and fraud review in large volumes, Boltic allows scaling to meet the needs of high volumes. It also scales well with Zendesk and Freshdesk, Slack, and existing banking systems. This makes it a one solution for all your workflow automation in finance needs.

The Future of AI in Finance

As AI models evolve, financial institutions will rely on them even more. We can expect:

- Broader use of generative AI for reports, insights, and customer communication

- More personalized advisory services

- Better prediction models for market volatility

- Automated compliance frameworks

- AI-powered ESG scoring and sustainable finance analytics

- Greater use of no-code AI platforms like Boltic.io for operational automation

The direction is clear: AI will become the backbone of modern financial operations.

Conclusion

AI in finance is no longer a theory. The results are measurable: billions saved from fraud prevention, millions of customers served better through AI chatbots, loans approved faster, and compliance handled smarter. The competitive advantage is taken by those institutions that act responsibly and at scale.

Whether you're evaluating AI solutions or designing workflow automation in finance strategies, platforms like Boltic make the adoption process faster and more accessible than ever before. To begin automation of key workflows, you don't require a huge technology team or several months of development time.

If you're in financial services and haven't started your workflow automation in finance journey, then start today, because there's no time like now.

drives valuable insights

Organize your big data operations with a free forever plan

An agentic platform revolutionizing workflow management and automation through AI-driven solutions. It enables seamless tool integration, real-time decision-making, and enhanced productivity

Here’s what we do in the meeting:

- Experience Boltic's features firsthand.

- Learn how to automate your data workflows.

- Get answers to your specific questions.

.avif)

.webp)